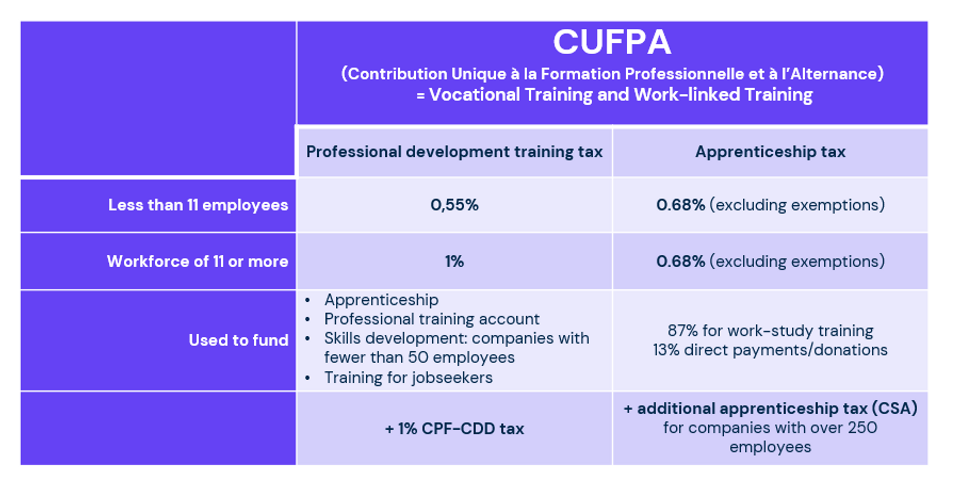

All employers, irrespective of the size of their workforce, contribute to the development of vocational training by financing training courses for their employees and by paying a contribution (CUFPA), the amount of which varies according to the number of employees.

The CUFPA is calculated based on the current year’s payroll rather than the previous year’s.

Since 1 January 2022, URSSAF has been collecting tax using the DSN.

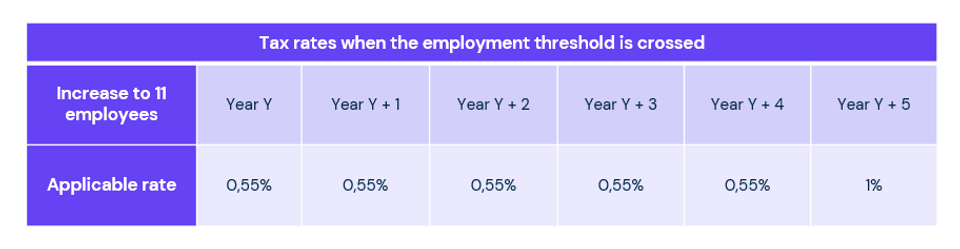

Smoothing of the CUFPA in case of crossing the workforce threshold

A company that reaches or exceeds 11 employees for the first time because of an increase in its workforce remains subject to the 0.55% rate for the current year and the following 4 years.

The application of specific rates smoothes the increase in the contribution when the threshold of 11 employees is crossed.

Please note: the smoothing does not apply if the increase results from the takeover or absorption of a company that employed at least 11 employees in any of the 3 previous years. In this case, the transition to the 1% rate applies from the year in which the number of employees reaches or exceeds 1