The tax reform concerning income from non-professional furnished rentals or “Locations Meublées Non Professionnelles (LMNP)” in French, which will come into force in France from 2024, brings significant changes for owners of furnished rentals.

The main measures of this reform

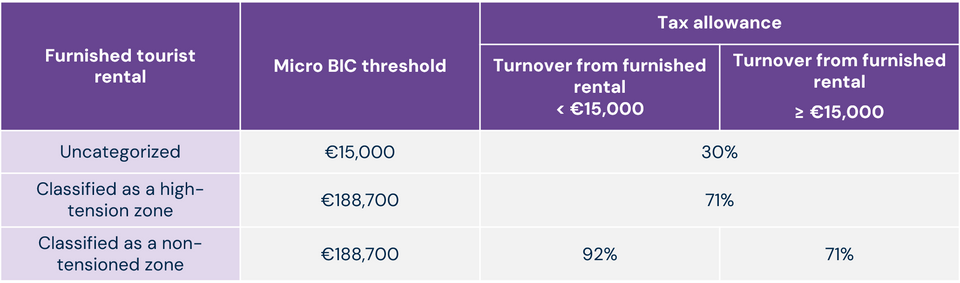

Revenue ceiling and allowance lowered for all “LMNP” schemes:

The following changes will apply to income received, from 1 January 2024:

- Reduction in the revenue ceiling¹ for the Micro BIC scheme to €15,000 for unclassified furnished tourist rental.

- Reduction in the allowance² from 50% to 30% for unclassified furnished tourist rental.

¹ Plafond de recettes (in French)

² Abattement (in French)

According to the French tax authorities (an appeal against this decision is currently before the “Conseil d’État”), it is important to note that these provisions may not apply to income from 2023, taxed in 2024.

The rules for 2023 income would be as follows:

-

Unclassified furnished tourist rental

Revenue of less than €77,700 with a 50%

-

Classified furnished tourist rental

Revenue of less than €188,700, with a 71% allowance

Additional allowance for certain furnished rentals:

The bill provides for two exemptions for classified furnished tourist rentals located :

- In rural areas.

- Or in classified winter sports and mountaineering resorts.

In these areas, an additional allowance of 41% will apply, provided if revenues for the previous year do not exceed €50,000. These provisions will come into force on 1 January 2024.

Extended exemption for certain rentals:

A small provision has been inserted into “Projet de Loi de Finances 2024”, to extend the tax exemption for rental of one or more furnished rooms in one’s principal residence to persons who do not elect domicile there, where the income from the rental does not exceed €760 including VAT per year. This rule, currently set to expire on 15 July 2024, would be extended to the end of 2026.

In short, this reform, which is far from complete, aims to adjust the taxation of furnished rentals, considering the specific features of different types of rental and geographical areas.

In summary, the 2024 “Loi de Finance” provides for the following: