A benefit in kind is defined as the provision by an employer of benefits, goods, or services to its employees free of charge or in return for a contribution that is less than their actual value: it is a saving on expenses that the employees would normally have had to bear. URSSAF therefore considers these benefits to be ancillary remuneration that must be subject to social security contributions and must appear on the pay slip. The start of the year is an opportunity to take stock of the two most significant benefits in kind: benefits in kind vehicle and accommodation.

The benefits in kind vehicle

The choice of valuation option

A benefit in kind vehicle is deemed to exist when an employee uses a company car for personal purposes. The employer can choose between two valuation options:

- a flat-rate valuation;

- or an actual valuation.

The choice of valuation option is made per calendar year.

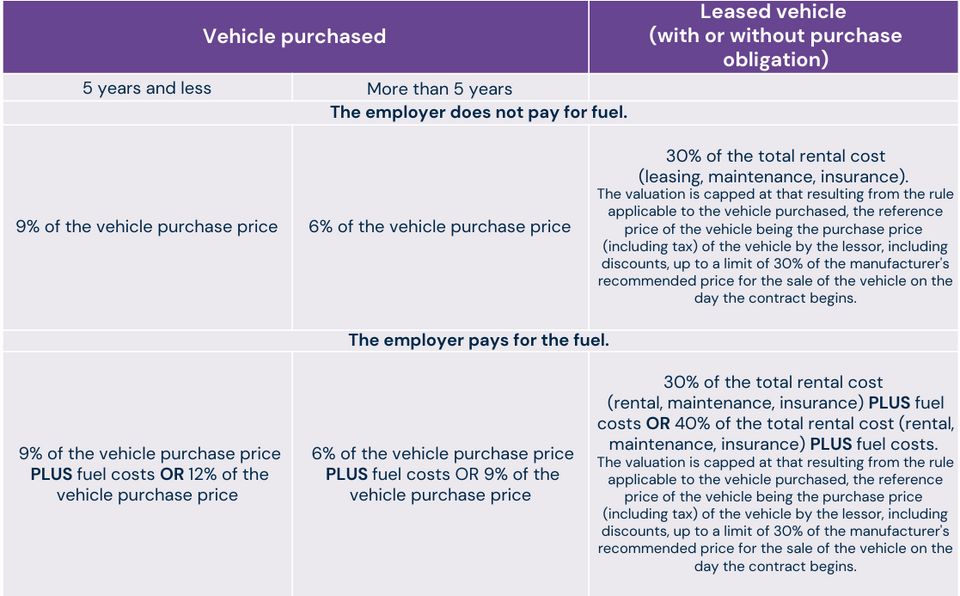

| Flat-rate valuation | Actual valuation |

| This method involves applying a percentage to the purchase price of the vehicle. The key point to remember is that the percentage applicable depends on the following parameters: . vehicle purchased or leased; . whether the vehicle is more or less than 5 years old; . fuel paid for by the employer. Cf. – Table of lump-sum valuation of benefits in kind for cars. | This method involves valuing the benefit in kind based on the expenses actually incurred. These expenses include: . depreciation of the purchase value of the vehicle over 5 years at a rate of 20% per year (10% for vehicles over 5 years old), or the total annual cost of the lease if the vehicle is leased; . insurance costs; . maintenance costs. The value of the benefit in kind is obtained: . by applying to the total thus obtained the ratio existing between the kilometers travelled by the employee for personal use and the total kilometers; . and adding, where applicable, the cost of fuel used for private use and paid for by the employer. |

The benefits in kind accommodation

The choice of valuation option

A benefit in kind accommodation is deemed to exist when the employer provides the employee with a home that it owns or rents free of charge.

As with benefits in kind vehicle, the employer can choose between the same two valuation options:

- a flat-rate valuation;

- or an actual valuation.

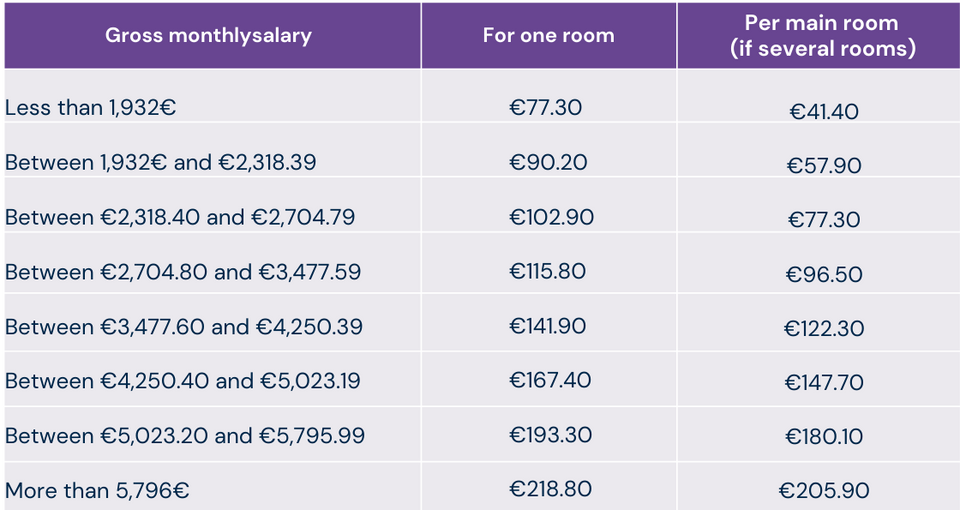

| Flat-rate valuation | Actual valuation |

| This method consists of valuing the benefit in kind based on the employee’s remuneration and the number of main rooms in the accommodation. Cf. – Table for lump-sum valuation of benefit in kind for accommodation. | This method consists of valuing the benefit in kind based on the rental value used to calculate council tax. |

The absence or undervaluation of a benefit in kind on an employee’s payslip can result in substantial adjustments in the event of an URSSAF audit. So don’t hesitate to ask your payroll manager about your practices on a regular basis, so that you can analyse the nature and value of the benefits in kind that exist within your company.

In addition, if there are any special circumstances (use of several vehicles by the employee, financial participation by the employee, etc.), please contact us to discuss the applicable rules.

Table of lump-sum valuation of benefits in kind vehicle

*Table provided by URSSAF

*Where the vehicle made available to the employee is a 100% electric vehicle, and until 31/12/2024:

– electricity costs paid by the employer are not taken into account when calculating the benefit in kind;

– there is a 50% allowance on the benefit in kind, capped at €1,800 per year.

Table of lump-sum valuation of benefits in kind accommodation

*Table provided by URSSAF

*Is considered a main room (cumulative conditions):

– any room used for sleeping or living;

– with an opening and transparent surface giving onto the outside.

Service rooms such as kitchens, bathrooms, etc. are not therefore considered to be main rooms.